tax lien nj foreclosure

Nationwide about one in every 854 homes had a foreclosure filing in the first half of the year. Upcoming NJ Tax Lien Sales - October 2022 REALTAXLIEN.

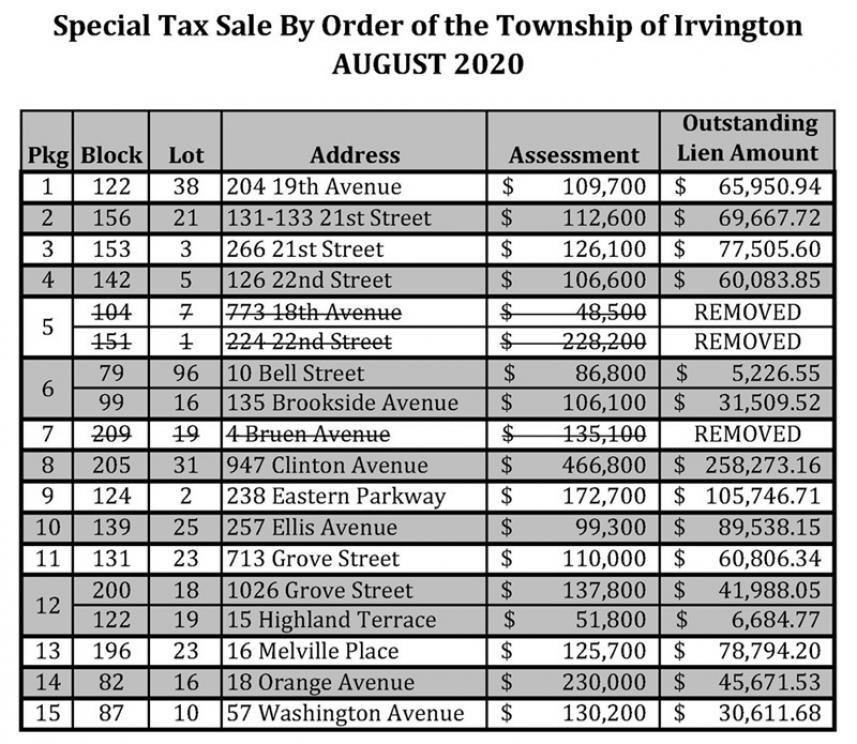

The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes.

. Construction Lien Notice of Unpaid Balance and the Right to File a Lien Amended Construction Lien Amended Notice of Unpaid Balance. Estimated Combined Tax Rate 800 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 200 and Vendor Discount 30-20 N. Delinquent Tax LienTax Certificate Foreclosure Sheriff Sales Land Sales and other municipal property auctions.

Understanding a Federal Tax Lien Centralized Lien Operation PO. Sales Tax and Use Tax Rate of Zip Code 29579 is located in Myrtle beach City Horry County South Carolina. The homeowner has to pay back the lien holder plus interest or face foreclosure.

Box 145595 Stop 8420G Cincinnati OH 45250-5595 Phone. If you buy a tax lien property and the property owner cannot repay you you might be forced to foreclose. NJ Non-Resident forms GITREP 1 1000 each.

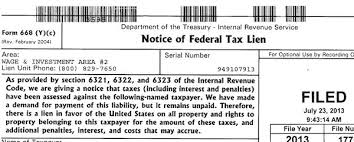

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. NJ Sellers Residency forms GITREP 1000 each. Puts your balance due on the books assesses your.

Release of Tax Liens. Box 8068 Trenton NJ 08650-0068 2022 Mercer County NJ. You could run into a sticky foreclosure problem.

The following is a list of the upcoming New Jersey Online Tax. Mercer County Administration Building 640 South Broad Street PO. IRS LiensWithdrawalsReleases are now searchable from 112010 to present.

Statute the municipality will enforce the collection of those charges by offering same for sale which will cause a Tax Lien Certificate to be sold and filed against the property and can become subject to foreclosure proceedings if not redeemed. Records Search - Search Criteria Municipality. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes.

In addition to the right to accelerate the foreclosure the tax lien holder also has the right from the date that she purchased the tax sale certificate to enter the property after written notice by certified mail to the owner in order to make repairs or remedy harmful conditions NJSA. Website Design by. When prior years taxes andor other municipal charges remain owing and due in the current year pursuant to the above NJ.

Foreclosure listings from RealtyTrac including pre-foreclosures house auctions and bank owned homes. Trenton NJ 08618 United States. In addition the Division is responsible for enforcement activities such as mailing delinquent notices holding an annual tax sale and providing lists of properties for tax foreclosure.

Licensed by the NH Banking Dept 6743MB. 800-913-6050 Outside the US. New Jersey Rocket.

Property owners who are permanently disabled senior citizens or veterans may qualify for property tax deductions if they meet income. New Jersey had double that. The lien protects the governments interest in all your property including real estate personal property and financial assets.

Deeds now searchable from 01011970 to present. 855-390-3530 Getting a lien release or lien payoff balance Publication 1450 Instructions on How to Request a Certificate of Release of Federal. Unreal spline mesh component.

A federal tax lien exists after. One in every 410 homes had a foreclosure filing according to ATTOM. Search over 1 million real estate properties updated daily.

Of Federal Tax Lien IRS website.

Tax Lien Law Haunts Massachusetts Property Owners

New Jersey Foreclosure Law Practice Lexisnexis Store

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate

How To Foreclose On A Construction Or Mechanic S Lien

New Jersey Tax Sales Tax Liens Youtube

Free Deed In Lieu Of Foreclosure Form Pdf Template

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Revision To The Tax Sale Law Tragedy For Distressed Homeowners New Jersey Law Journal

Priority Enforcement Of Irs Liens Against Nj Real Estate

Nj Foreclosure Lawyer The Process And Defense In 2022 Curbelo Law

Keeping Your Home After A Nj Tax Foreclosure Sale